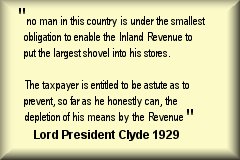

Tax Mitigation Strategies to reduce and avoid UK tax

A tax mitigation strategy, executed correctly, can make tax

an avoidable expense.

|

Your tax accountants or other tax advisors will calculate your tax liability. We will then work with them to identify and resolve complex tax problems. We provide you with the specialist tax mitigation and avoidance strategies needed to make tax savings.

We specialise in tax mitigation strategy advice for inheritance tax, income tax, corporation tax and capital gains tax.

We work in both the Private and Corporate market place, advising and assisting private individuals, directors, and limited companies.

Do you have a tax problem?

We can help you if you are :

- A high earner or a high net worth individual with exposure to Higher Rate Income Tax

- An individual who has disposed of an asset, such as property or shares, and has been assessed for Capital Gains Tax

- A successful company director with substantial profits liable to Corporation Tax

- An individual who has assets of more than £255,000 and a potential Inheritance Tax liability

We will minimise your tax liability, and in many cases reduce it to zero. We are committed to professionalism, fiscal innovation, and the application of sound and competent financial guidance in dealing with our clients’ financial affairs.

This site provides some example tax strategies, but to get the best results each case needs individual, personal service. So contact us now and let us formulate the right tax advice for you to maximise tax savings.

Tax mitigation home | Income tax mitigation | Capital gains tax mitigation Inheritance tax mitigation | Corporation tax mitigation